IMMEDIATE ROADSIDE SANCTIONS

7 Days to Act: Challenging Your Alberta IRS Penalty

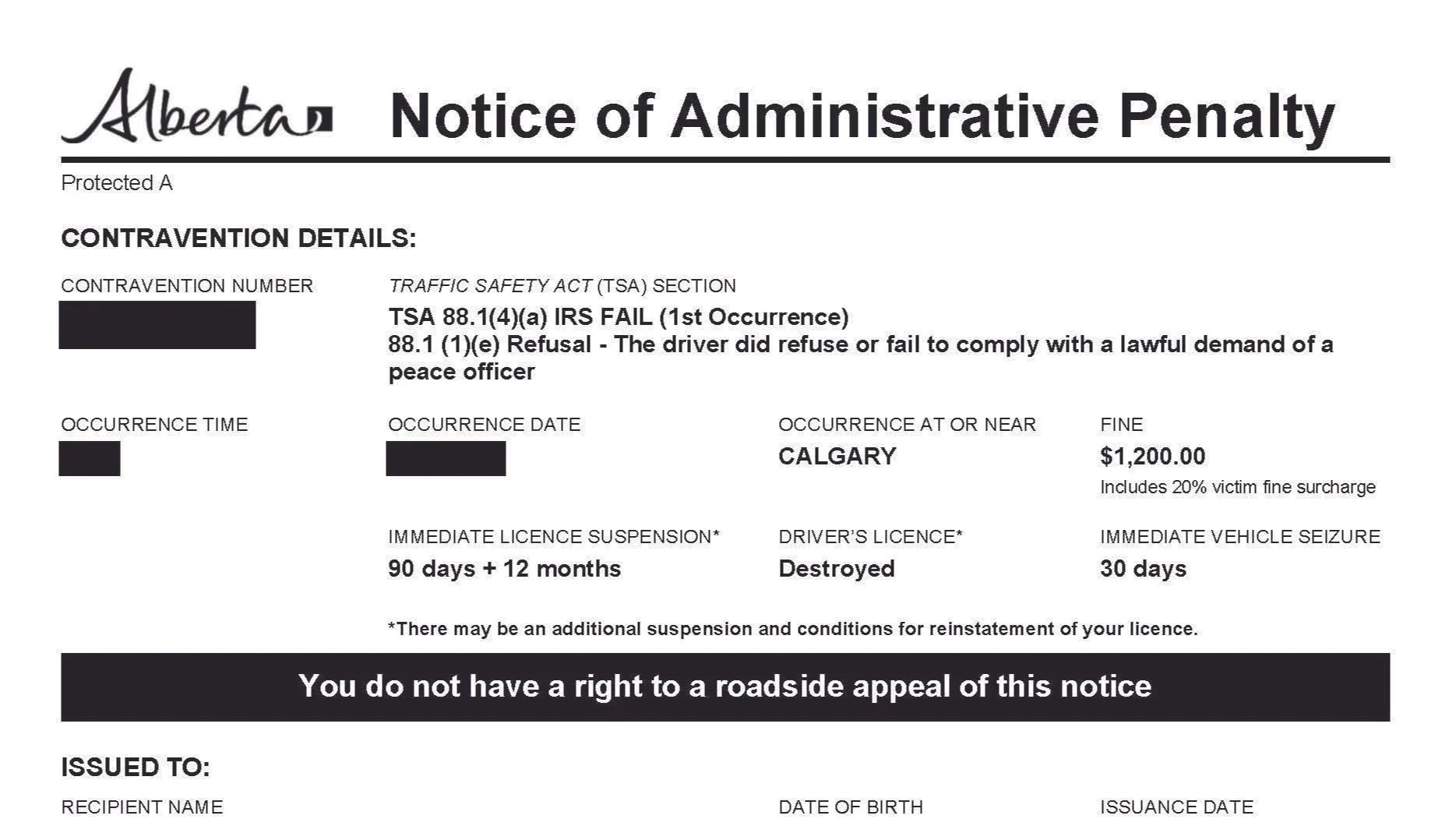

Receiving a Notice of Administrative Penalty (NAP) on the side of the road is an overwhelming experience. Under Alberta’s current Traffic Safety Act (TSA), police officers have been granted significant authority to issue immediate penalties—including license suspensions and vehicle seizures—without a court hearing.

However, these police powers are not unlimited. The system requires officers to follow strict legislative rules. If they deviate from these rules, even slightly, the sanction may be cancelled.

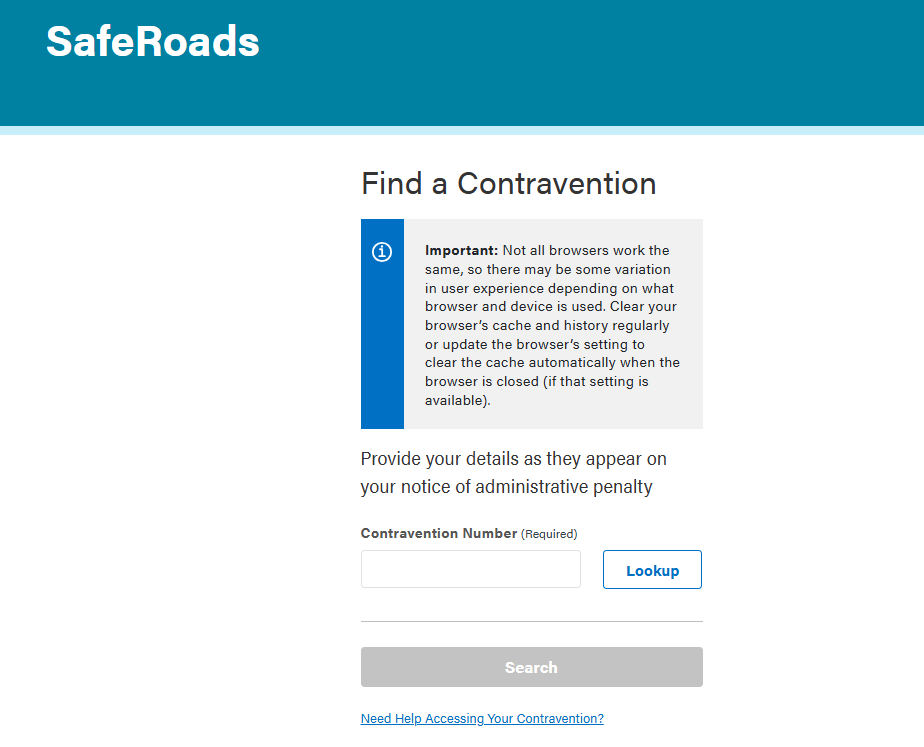

At Cheema Criminal Defence, we help drivers navigate the SafeRoads Alberta appeal process. Below is an overview of how we scrutinize the evidence to build a defence.

Understanding Your Sanction

The first step in your defence is identifying exactly which section of the Traffic Safety Act has been applied to you. The specific "Grounds for Review" depend on whether you were charged as a novice, a commercial driver, or under the general impairment laws.

We defend against all categories of IRS penalties, including:

IRS: FAIL (Section 88.1): The most severe penalty, usually resulting in a 15-month suspension, 39 months for the second occurrence and a lifetime suspension for the third occurrence.

IRS: WARN (Section 88.03): Typically for BAC levels between 0.05 and 0.08.

IRS: NOVICE (Section 88.01): Zero tolerance violations for GDL drivers.

IRS: COMMERCIAL (Section 88.02): Zero tolerance for those operating commercial vehicles.

IRS: 24-HOUR (Section 88): Suspensions for suspected impairment by drugs or alcohol.

It is vital to understand that an IRS review is not a criminal trial. In a criminal court, you are presumed innocent until proven guilty. In the IRS administrative system, you are presumed guilty until you prove one of the grounds of cancellation of the NAP.

Essentially, the onus is on you (the driver) to prove that the police officer erred or that the cancellation grounds have been met. This "reverse onus" makes it incredibly difficult to win without a strategic legal argument. You cannot simply say "I wasn't impaired"; you must prove a specific legal failure occurred.

Building a Defence

Because we cannot rely on the "benefit of the doubt," our strategy focuses on finding factual and technical errors in the police disclosure. Generally, successful appeals fall into two categories:

Statutory and Procedural Compliance

Police officers must follow a rigid checklist when issuing a roadside sanction. We conduct a forensic review of the disclosure (the police notes, videos, and certificates) to answer questions such as:

Did the officer have the requisite grounds to demand a breath sample?

Was the breathalyzer device calibrated correctly and within the required timelines?

Did the officer issue the Notice of Administrative Penalty (NAP) immediately, as required by law?

Are there discrepancies between the officer's written notes and the driver’s version.

Constitutional Rights (Charter Violations)

Even in an administrative setting, you are entitled to procedural fairness. While the Charter of Rights and Freedoms applies differently here than in criminal court, breaches of your fundamental rights can still form the basis of a successful defence, especially when the investigation was conducted in a way that was fundamentally unfair or biased.

Why the "Details" Matter

In the world of IRS appeals, the law is clear in some respects and imposes a duty on police officers to follow the legislative guidelines. A failure by the police to adhere to the Traffic Safety Act protocols can be fatal to their case against you.

If you have received a NAP, the clock is ticking. You typically have only 7 days to file for a review. Do not let the deadline pass without investigating your options.

IRS disclosure and Missing Records

One of the strongest grounds for cancelling an IRS is a lack of disclosure of a relevant recond that must have been disclosed under the Regulation.

Under the SafeRoads Alberta Regulation, the Director must provide you with all relevant records regarding the investigation. If the police fail to upload these documents to the portal, we may be able to argue that a particular ground of cancellation has been made out.

We meticulously review the disclosure package for missing items, which must often include but not be limited to:

Officer’s Notes: The handwritten or typed notes detailing the traffic stop.

Checklists: The specific operational checklists used for the breathalyzer or drug screening device.

Calibration Records: Maintenance logs proving the Approved Screening Device (ASD) was properly calibrated and serviced within the required timeframe.

Certificates of Analysis: For breath or blood samples taken at a detachment.

Any other records that may be relevant and necessary based on the facts of the case, and that may be necessary to know the basis of the Notice of Administrative Penalty.

For example, if the police cannot produce the records for the device you blew into, how can they prove it was working correctly? We use these gaps to attack the validity of the test results.

Approved Screening Device (ASD)

This is the handheld device you blew into at the window of your car. The police must provide:

Annual Maintenance dates: Proof that the device was serviced within the last year.

Calibration Records: Documentation showing the device was calibrated properly and that the calibration had not expired at the time of your stop.

Approved Instrument (AI)

If you were taken to a detachment or a Checkstop bus for a more accurate breath test, the documentation requirements are even stricter. We look for:

The Subject Test Record: The actual printout of your results.

Standard Change Forms: Proof that the alcohol standard used to verify the machine's accuracy was changed correctly.

Certificate of Qualified Technician: Evidence that the operator was actually trained and certified to use that specific machine.

The Legal Argument: If any of these documents are missing, incomplete, or show dates that don't match, we argue that the Director cannot be satisfied that the readings were accurate.

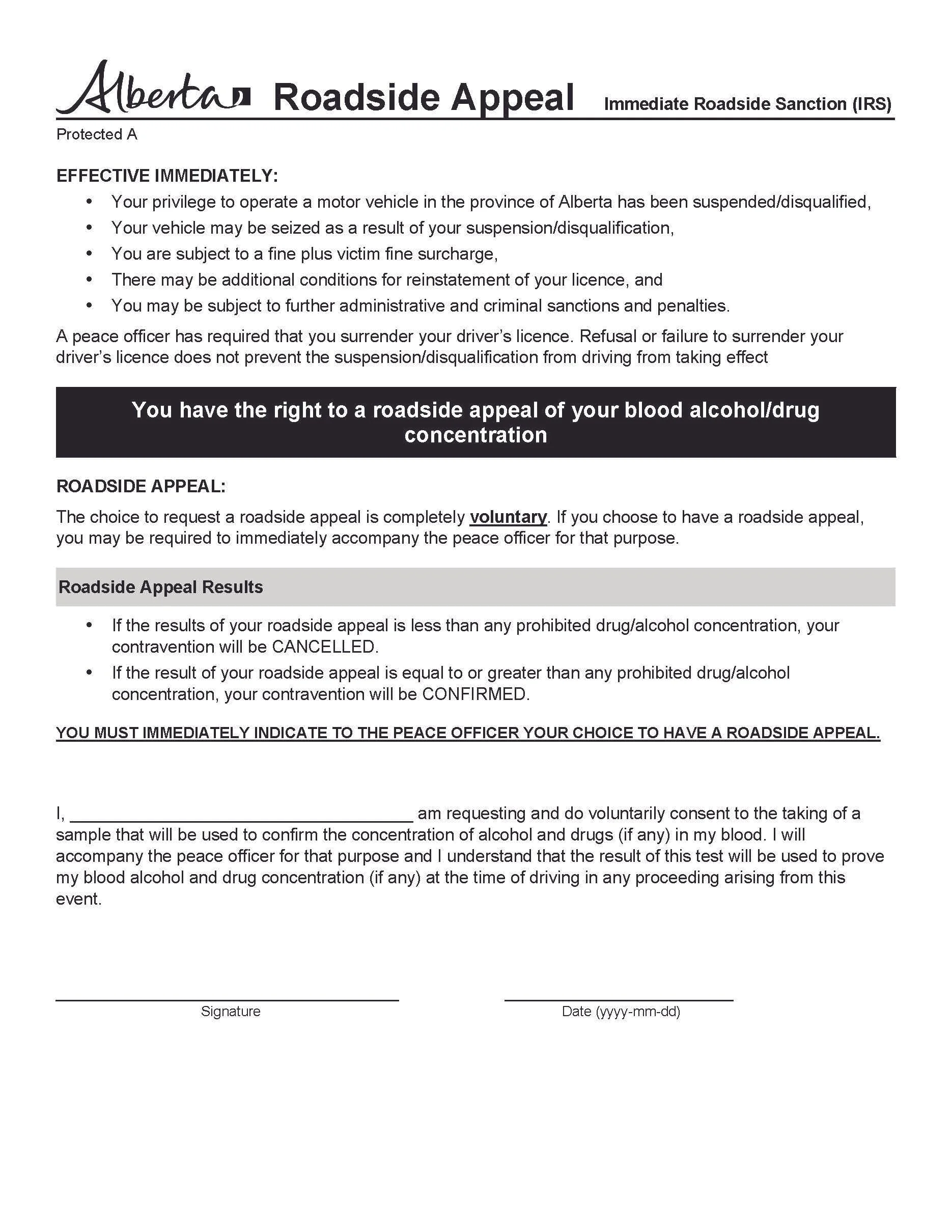

Please note that the December 15, 2021 Amendments to the Saferoads Regulation repealed a recipient’s right to a roadside appeal when the basis of the Notice of Administrative Penalty (NAP) is issued for Failure/Refusal to comply with the breath demand.

Your Right to a "Second Test" (Section 88.11 TSA)

The test for whether an IRS recipient has been advised of their right to a roadside appeal is twofold: first, whether the police advised them of their right to a roadside appeal in writing; and second, whether they were aware of their right to a roadside appeal before they requested to do the test or decline it.

The Courts have always expressed concerns regarding the reliability of the roadside screening devices. Therefore, it is crucial that a roadside impaired driving investigation has the necessary safeguards.

Alberta’s legislation incorporated the right to a roadside appeal so the NAP recipient could challenge the NAP at the roadside by doing a second test. The recipient can also choose tod decline the second test as it is a voluntary right.

One of the most overlooked procedural defences involves your right to a second analysis. Under Section 88.11(2) of the Traffic Safety Act, if you request a second test, the police must perform it using a specific method. They cannot just choose whatever is convenient.

If the officer used the wrong device for your second test, the procedure is flawed. Below is a breakdown of the required protocol:

When a first test is on ASD then a second test (if requested) can be a test on a different ASD or an Approved Instrument (detachment machine).

In cases involving Standard Field Sobriety test or drug inmpaired cases, a second test can be a blood or urine test (DRE).

Why You Should Challenge an IRS (It’s Not Just About Today)

Many drivers consider accepting the suspension to "get it over with." However, the Traffic Safety Act is designed to punish repeat offenders with increasing severity.

If you accept an IRS: FAIL today without a fight, it stays on your record.

1st Offence: 15-month suspension.

2nd Offence: 39-month suspension.

3rd Offence: Lifetime suspension.

Further, the Traffic Safety Act stipulates that anyone served with a provincial sanction under the previous 88.1 TSA provisions at sec. 88.1(17) (effectively anyone issued an AALS between 2018 and 2020) is considered to be a second or subsequent offender under Saferoads Alberta’s regime.

Because an administrative review does not offer the same protections as a criminal trial—there is no presumption of innocence and no ability to cross-examine the officer—the paperwork is your only defence. You cannot "talk your way out of it" at a hearing; you must prove one of the grounds of cancellation.

Understanding the Burden of Proof

In a criminal trial, you are innocent until proven guilty. However, in an IRS appeal, the burden of proof is reversed.

The legislation creates a "presumption" that the Notice of Administrative Penalty is valid. The onus is on you to prove, on a balance of probabilities, that the officer erred or that a particular ground of cancellation has been met.

This is why "DIY" appeals may not be the best route to take. Without a technical understanding of what the police must provide, it is difficult to discharge this burden. We attempt to identify the imperfections that can win your case.

The 7-Day Deadline

You have only 7 days from the date of the incident to file for a review. If you miss this window, the suspension is typically confirmed automatically.

If you have received a NAP, contact us immediately. Once retained, we will review the disclosure, including the police records for errors, and present a structured argument to SafeRoads Alberta on your behalf.

As an Immediate Roadside Sanctions (IRS) Lawyer fluent in Punjabi and Hindi, I ensure my clients fully understand all evidence and available legal options.

Disclaimer: The information provided in this article, including references to the Traffic Safety Act and SafeRoads Alberta Regulation, is for educational purposes only. It does not constitute legal advice. Every IRS appeal depends on the specific facts of the investigation. For a review of your IRS case, please contact our office.